Wise Review: Sending money and receiving money across the country can be tedious. Some can even take a whole lot of time not to talk of some that never get to the recipient’s. The right money transfer app can save you lots of headache.

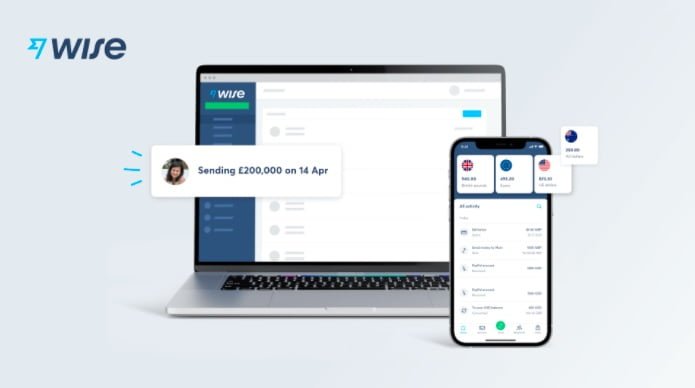

This is where the Wise Money Transfer services comes in. As an international money transfer app, is it safe to use Wise (formerly called Transferwise) to send money abroad? In this review, I’ll talk about Wise, how easy it is to use, its transfer charges, its legality and also safety.

See Also: Western Union Review: Still the best Money Transfer App

Wise Review

About Wise

Wise formally known as Transferwise is financial technology company based in London. Its service include; sending, receiving and saving money. With Wise, you can send money to your friend, family, or business partner living anywhere around the globe.

It is one money transfer app that has very low cost fees and even has a dynamic cost calculator that allows you to calculate your transfer fees upfront right before sending out money. In this case, there is no room for hidden charges.

See Also: Skrill Review: Is Skrill a Safe Digital Wallet Provider

As an online platform, Wise offers bank to bank international transfers. But it offers cheaper service fees compare to banks. Hence, you get to save a lot of money while using it. Wise is one of the best for transfers under $7000 as it is said to be the cheapest.

The founder of Wise are Estonian businessmen Kristo Kaarmann and Taavet Hinrikus. It was founded on 31st March 2010 but launched in January 2011 with the vision of making international money transfers cheap, simple, and fast. This it has achieved effortlessly.

Wise is accepted by a wide range of countries which includes Argentina, China, Colombia, Ghana, Nigeria, Canada, South Africa, United Arab Emirates, United Kingdom, United States of America to mention but a few.

See Also: How to Open and Verify Skrill Account in 10 minutes

Is Wise Easy To Use

The ease of using wise to send and receive money is one that needs to be adopted by other online money transfer apps. Wise App is very easy to use, easy to understand, and no hidden fees. Users get to see the transfer charge upfront before making transfers. It is not only easy to use by also has a fast track of transfers.

For those working in another country and residing in another, you can use wise to receive salaries, pension, benefits and more with ease.

The wise website is straightforward and very accessible to its users. Wise had multiple payment methods ranging from bank transfers, credit cards, anyone just for your use.

See Also: How to send, receive and deposit money on Skrill in 5 minutes

Wise Transfer Charges

Like earlier said, wise offers you a cost calculator where you get to see your transfer fees and rates before making transfers. These fees are very favorable and quite low unlike other transfer apps. Wise does not have any hidden fees as you are able to see the fees upfront.

For business purposes, there is a special feature that allows you to receive money in other currencies for free without any charge. They often charge some percentage like 0.33% -3.56% to convert those currencies.

See Also: What is crypto.com: Everything you need to know

Is Wise Legal

Yes, Wise is legal. Wise services are legal in over 80 countries which includes Australia, Argentina, United States of America, United Kingdom, Canada, United Arab Emirates, South Africa to mention but a few.

Wise is a registered company in London, United Kingdom and it is properly regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States and other agencies around the world.

See Also: How to Sell Crypto in Canada on Binance Mobile App

Is Wise Safe and Secure

One thing is transferring money online and another is, is your money safe? A lot of people have lost their money in online money transfer apps but that is not the case with wise.

Wise has the latest security encryption which helps to protect the money of their customers. Wise has a robust security encryption which helps to safeguard the information you share. In the app you can also do a two factor authentication for more security.

See Also: How to withdraw Eur from Binance to bank Account

Wise has bank accounts with 1st class banks like JP Morgan Chase, Barclays and Deutsche Bank. In this case, even if there is an issue, your money transfer is always secure. But note that you have to safeguard your Wise account details such as: email, password, security questions and answers.

Why Use Wise

Why sending and receiving money, you need an app that is easy to use, reliable, fast, cheap, with adequate security, this and more are available with Wise. Not only that, it is also said to be one of the best money transfer app according to research.

See Also: Binance Wallet: How to send and receive crypto on Binance App

Below are some of the reasons why you might want to try Wise when sending your next money overseas:

- Wise is very easy to use.

- It has a very favorable exchange rate which is based on the mid-market rate.

- It has a robust security encryption that protects your personal information and your money from hackers or fraud.

- The speed of transfer for most transaction is very recommendable unlike other transfer apps say 1-2 business days for most transfers.

- Wise has no hidden fees as you have a cost calculator on the website which helps you to see the fees upfront before making any transfers.

- Wise has a very good online support system.

- If you are looking to transfer or receive money via bank transfer, wise is the cheaper option for you.

From this Wise review, you can see that the platform is easy to use, its reliable, its safe, and offer lower service charge. So to answer the question at the beginning, is it safe to use Wise, the simple answer is YES. But you have to keep your account details safe to avoid it getting into the wrong hands.